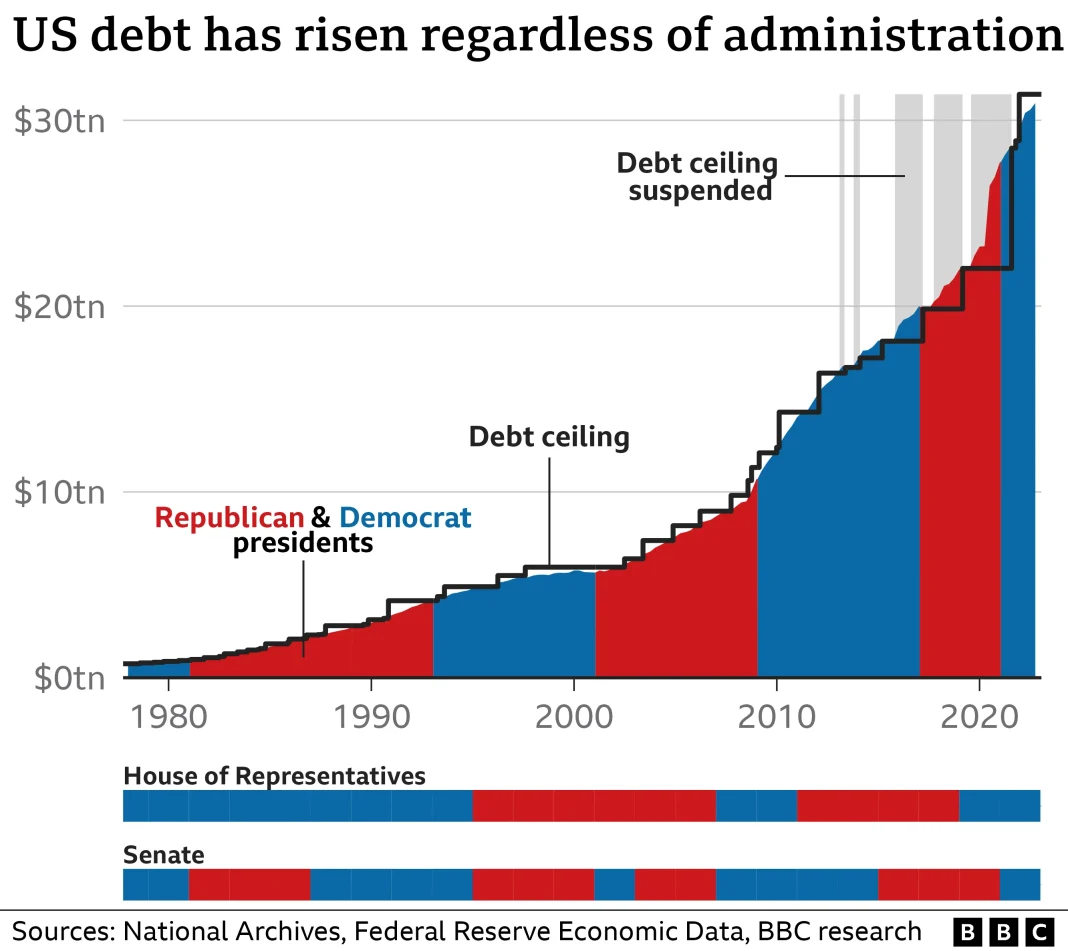

The US debt crisis has escalated dramatically, with the national debt surpassing an alarming $38 trillion. This rapid increase highlights a troubling trend of unchecked spending, causing lawmakers from both political parties to voice concerns about the long-term implications. As the debt-to-GDP ratio now stands at a staggering 120.63%, discussions around budget balancing and its potential economic consequences have intensified. Financial experts are warning that unless substantive action is taken, Americans could face serious ramifications, including a potential sovereign debt crisis. In this context, many are beginning to explore investing in alternative assets to safeguard their financial futures amid such uncertainty.

The current financial predicament facing the United States, often referred to as the national debt dilemma, poses significant risks to the economy. Exceeding $38 trillion in governmental liabilities, this economic burden raises serious questions about fiscal management and sustainability. Key metrics, such as the debt-to-GDP ratio exceeding 120%, paint a bleak picture for future stability. Policymakers are urged to consider strategic budget balancing to avert dire economic consequences stemming from escalating debt levels. As individuals seek to protect their investment portfolios, exploring alternative assets has become increasingly pertinent in today’s tumultuous financial landscape.

Understanding the US National Debt Crisis

The US national debt has soared past the $38 trillion threshold, triggering alarms among economists and policymakers about the sustainability of such enormous fiscal obligations. As the debt accumulates at an unprecedented pace, the implications grow apparent; not only does it threaten the financial stability of the United States, but it also raises urgent questions about future economic policy. With a staggering debt-to-GDP ratio of 120.63%, the weight of this national debt could hinder economic growth, limiting the government’s ability to invest in vital sectors such as education, infrastructure, and healthcare.

As debt levels continue to escalate, we confront a critical juncture; the choices made today will echo for generations to come. Politicians across party lines must grapple with the tough realities of budget balancing and the need for fiscal responsibility. The crux of the issue lies in whether the government can curtail spending to avert a potential default. Failure to act could usher in dire economic consequences, transforming a slow decline into a rapid fiscal catastrophe.

Economic Consequences of Rising Debt

The ramifications of escalating national debt are profound and multifaceted, with the potential to resonate through every segment of the economy. Economists warn that excessive borrowing can lead to higher interest rates, which stifle private investment and hinder long-term economic growth. Moreover, an increasing debt burden could diminish the government’s credibility, making it more challenging to finance future borrowing needs, leading to a vicious cycle of rising interest rates and diminished economic performance.

In addition to crippling economic growth, the rising debt poses a direct threat to the American Dream. As government resources become increasingly strained due to servicing debt, opportunities for social mobility may decline, limiting access to education and quality jobs. The trend of rising national debt, coupled with the associated elevated debt-to-GDP ratio, suggests a settling of accounts that could necessitate painful adjustments in public policy and private sector financial strategies.

Balancing the Budget: Challenges Ahead

Despite warnings from financial experts and lawmakers, Congress appears no nearer to a balanced budget or fiscal accountability. The trend of increasing government expenditure without adequate revenue generation continues, reflecting a broader systemic issue of prioritizing short-term political gain over long-term economic stability. Bipartisan disagreements over spending cuts and revenue generation exacerbate the challenges of achieving a balanced budget, placing the nation in precarious territory.

Emphasizing the importance of addressing these financial challenges, analysts urge a comprehensive review of fiscal policy, advocating for smarter budget management and strategic investments that serve both current and future generations. If lawmakers fail to navigate these challenges effectively, the US could face not only higher debt levels but also stagnant growth, undermining the economic prospects of future generations.

Investing in Alternative Assets Amid Uncertainty

In light of the escalating national debt and uncertain economic future, many investors are reconsidering traditional investment strategies. Financial advisors recommend diversifying portfolios by integrating alternative assets—such as real estate, commodities, and cryptocurrencies—to hedge against potential downturns linked to rising debt and economic volatility. These alternative assets may provide stability in turbulent times and serve as a buffer against inflation.

As the national debt continues to loom large, alternative investments can be seen as a proactive strategy for mitigating risk. By broadening their investment base, individuals can potentially guard their assets against the impact of increasing debt levels and the risk of inflation eroding purchasing power. Such strategic diversification not only helps to weather financial storms but also positions investors to capitalize on opportunities in emerging markets.

The Future of the US Economy: Predictions and Concerns

With projections indicating that the national debt could exceed $53 trillion by 2035, significant concern looms over the US economy’s future. Analysts warn that absent substantial political will and actionable policy reforms, the nation could experience a loss of investor confidence, triggering soaring interest rates and a fundamental reshaping of the economic landscape. Such changes could translate into higher costs of borrowing for consumers and businesses alike, impacting everyday Americans.

Moreover, without decisive action from Congress to implement budget reforms, the cycle of rising debt may persist unchecked, leading to potential economic stagnation. Fixed income investors, in particular, should remain vigilant; as the consequences of extensive borrowing unfold, the landscape of fixed-income investments may shift dramatically, forcing a reevaluation of long-standing investment principles. Individuals and businesses alike must prepare for an uncertain economic future.

Legislative Responses to the Debt Crisis

In response to the escalating US national debt, legislative measures are critical to restoring fiscal stability. A mixture of budget cuts, strategic spending reallocations, and potential tax reforms may be necessary to rein in the deficit. Lawmakers face the difficult challenge of crafting bipartisan solutions that address immediate fiscal concerns while laying a foundation for long-term sustainability. The road ahead demands careful negotiation and compromise, as all eyes remain fixed on Congress’s actions.

Moreover, understanding the interconnectedness of the economy is vital; any legislative attempt to rectify the debt crisis must consider the broader impact on the national economy, jobs, and health services. As discussions of budget balancing take center stage, a comprehensive approach that emphasizes both economic efficiency and social equity will be paramount. Only through collective action and responsible governance can the US secure its financial future.

Public Awareness and Involvement in Fiscal Policy

As the national debt crisis escalates, ensuring public awareness and involvement in fiscal policy becomes essential. Citizens must understand the implications of rising debt not only on their financial security but also on the broader economic environment. By fostering an informed electorate, policymakers may be better equipped to implement durable solutions that reflect the will of the people while addressing urgent fiscal concerns.

Encouraging dialogue and debate around national debt and budget policies can lead to enhanced accountability among elected officials. Grassroots movements and public forums provide platforms for discussing critical issues like the debt-to-GDP ratio and budget balancing, empowering citizens to demand responsible fiscal management. Only through an engaged and informed citizenship can the US hope to navigate the complexities of national debt with collective resolve.

The Role of Education in Addressing Fiscal Responsibility

Promoting financial literacy and education is crucial in addressing the nationwide challenge of fiscal responsibility. As the US grapples with rising national debt, equipping citizens—especially the youth—with knowledge about budgeting, investing, and economic principles can foster a culture of accountability that extends into adulthood. Education programs focused on economic responsibility will help future generations build a solid financial foundation despite potential economic uncertainties.

Moreover, enhancing public understanding of the implications of national debt will empower voters to make informed choices about their representatives and policies. By embedding fiscal responsibility into educational curricula, we cultivate a populace that prioritizes sustainable economic practices, fostering engagement and activism around budget issues that can shape the nation’s economic trajectory for years to come.

The Importance of Sustainable Economic Policy

Moving towards a sustainable economic policy is essential given the current trajectory of US national debt. Policymakers must evaluate long-term economic strategies that prioritize fiscal prudence and accountability while fostering growth. Faced with mounting pressure from global economic challenges, the necessity for a robust economic framework becomes ever more critical.

Sustainable economic policy should encompass a balanced approach to government spending, tax reform, and investment in infrastructure and education. As long-term planning remains a priority, addressing the debt crisis through collaborative strategies will foster resilience within the economy and create a solid foundation for future generations.

Frequently Asked Questions

What is the significance of the US national debt surpassing $38 trillion?

The US national debt surpassing $38 trillion is significant as it marks a critical increase from earlier levels, highlighting growing concerns over fiscal sustainability and economic stability. This escalation raises alarms about the country’s ability to balance its budget and the potential long-term implications for economic growth.

How does the debt to GDP ratio affect the US debt crisis?

The debt to GDP ratio, currently at 120.63%, signifies that the national debt has outpaced economic growth, which can lead to greater borrowing costs and reduced investor confidence. A high debt to GDP ratio is often viewed as a warning sign, suggesting that the US may struggle to manage its debt responsibilities, which is central to the ongoing debt crisis.

What are the economic consequences of the US debt crisis?

The economic consequences of the US debt crisis can be severe, potentially leading to slower economic growth, increased interest rates, and a loss of confidence from creditors. If spending continues unchecked, it could result in either prolonged stagnation or a sudden sovereign debt crisis.

What actions are being taken to address US budget balancing amid rising debt?

Despite rising debt levels, lawmakers, as noted by Senators Rand Paul and Rick Scott, are currently no closer to effectively balancing the budget. The lack of substantial action fuels concerns over further debt accumulation and its impacts on fiscal policy.

Why should investors consider investing in alternative assets during the US debt crisis?

Investors should consider investing in alternative assets amid the US debt crisis to diversify their portfolios and mitigate risk. Financial strategists like David Kelly suggest such strategies, anticipating that escalating debt levels could prompt market instability and loss of investor confidence.

| Key Point | Details |

|---|---|

| US National Debt Milestone | The national debt has surpassed $38 trillion, increasing significantly in a short period. |

| Current Debt Statistics | Debt per citizen stands at over $110,000 with a debt-to-GDP ratio of 120.63%. |

| Political Response | Senators Rand Paul and Rick Scott have criticized Congress for failing to balance the budget, calling the situation unsustainable. |

| Economic Implications | Warnings suggest that sustained debt levels could lead to economic stagnation or a sovereign debt crisis. |

| Investor Recommendations | Financial advisors encourage diversification of assets to guard against potential economic downturns. |

| Future Projections | Estimates predict national debt could exceed $53 trillion by 2035 if no action is taken. |

Summary

The US debt crisis has reached a critical juncture as the national debt surpasses $38 trillion, alarming economists and politicians alike. With rising debt per citizen and a high debt-to-GDP ratio, concerns about sustainability loom large. Lawmakers express urgency for corrective measures, emphasizing the importance of fiscal responsibility to protect the American economy from potential crises. Investors are advised to reconsider their strategies, reminding everyone of the pressing need to address the implications of this burgeoning crisis.