In the realm of US government shutdown prediction markets Kalshi Polymarket, traders are watching every headline for signals. Kalshi and Polymarket have turned government shutdown bets on the timing and outcome of a funding lapse into a live barometer of market sentiment. With bets opening and volumes rising, probabilities around a shutdown have hovered near the 78% mark according to market metrics. Supporters argue that prediction markets price political risk efficiently, while skeptics warn about volatility and potential manipulation. As the debate continues, these markets remain a lens into how investors interpret policy stalemates and their potential fallout.

Beyond traditional betting platforms, this trend translates policy risk into live data on crowd-sourced forecast markets. From a terminology perspective, readers may encounter phrases like federal funding lapse, budget brinkmanship, legislative impasse, or policy uncertainty instead of simply the ‘government shutdown’ label. These LSI-friendly terms reflect the same underlying risk signals that inform traders and policymakers about timing, fiscal impact, and market reactions. Whether branded platforms such as Kalshi and Polymarket or neutral marketplaces host these forecasts, the approach mirrors a broader shift toward real-time risk pricing and decision-relevant data. In short, digital prediction markets function as a barometer for expectations about policy outcomes and their economic ripple effects.

US government shutdown prediction markets Kalshi Polymarket: A Done Deal?

The coverage of a potential U.S. government shutdown has become a focal point for prediction markets, with Kalshi and Polymarket treating the event as a tradable outcome. In recent notes, the two platforms have positioned the likelihood of a shutdown well above the typical political risk baseline, signaling that market participants are pricing in a substantial probability even as lawmakers negotiate. The framing of this event as a “done deal” by many market observers is reinforced by bids and open contracts that reflect a high level of confidence among traders who follow political developments closely.

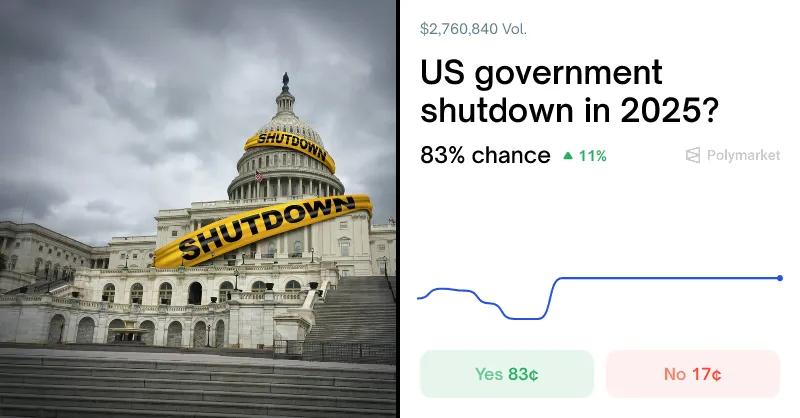

On Kalshi and Polymarket, the near-term odds for a government shutdown sit above 78%, a figure that underscores the market’s expectation of extended impasse. Traders are not simply guessing; they are hedging risk and seeking exposure to outcomes that could have broad economic consequences. As bets accumulate, platforms report notable volume, with more than four million dollars turning over as bettors speculate on the duration and severity of any shutdown. The sentiment that a shutdown could become inevitable is a common thread among participants who monitor legislative stasis and public policy signals.

How Kalshi and Polymarket Shape Prediction Markets for Political Events

Prediction markets like Kalshi and Polymarket have emerged as a practical barometer for political risk, translating complex legislative dynamics into tradable contracts. Users buy and sell event-based bets that hinge on outcomes such as government funding, budget approvals, and shutdown status. This structure converts political uncertainty into liquidity and price discovery, offering a window into how participants weigh different scenarios and how those weights shift with news cycles.

The two platforms specialize in political event contracts, creating a marketplace where “prediction markets” meet real-world policy stakes. By aggregating diverse bets, Kalshi and Polymarket contribute to a broader ecosystem that values timely information and probabilistic thinking. The resulting prices function as a gauge of sentiment, helping investors, policymakers, and casual observers understand how far market participants are willing to stretch their risk appetite in response to congressional negotiations and economic implications.

Current Odds and Trading Volume on Kalshi and Polymarket

Current odds on Kalshi and Polymarket place the probability of a federal government shutdown in the high-70s, illustrating robust demand for political-event contracts. This pricing reflects anticipated outcomes as lawmakers confront funding deadlines and partisan stances, with traders placing bets accordingly. The markets’ ability to quickly absorb this demand highlights the growing importance of prediction markets in political discourse.

Trading volumes have been substantial, with reports of over $4.6 million in bets at the time of writing. Kalshi, in particular, has captured attention for volumes approaching or surpassing levels seen on major election days, signaling deep participant engagement. This liquidity not only supports meaningful payouts but also underpins a broader narrative that market participants are actively wagering on the trajectory of U.S. government funding and the potential consequences of a shutdown for federal workers and the economy.

What Bets on a Government Shutdown Reveal About Market Psychology

Bets on a government shutdown offer a lens into market psychology, where risk tolerance, information flow, and herd behavior converge. Prediction markets attract degenerate bettors seeking high-risk, high-reward opportunities, as well as investors who view contracts as hedges against potential economic disruption. This mix can magnify volatility while providing a counterbalance to traditional polling by incorporating real-time trading signals.

The dominant narrative among participants centers on the belief that political stalemate will persist long enough to trigger a funding lapse. As funds flow into government shutdown bets, the market prices in consequences like payroll disruptions, economic ripple effects, and policy uncertainty. Even when negotiations appear tenuous, the market’s willingness to price in a sustained stalemate demonstrates how swiftly sentiment can become a self-fulfilling signal within the prediction markets ecosystem.

The Role of Prediction Markets in Legislative Deadlocks

Prediction markets have positioned themselves as one of several tools used to interpret the political process during legislative deadlocks. Platforms such as Kalshi and Polymarket aggregate diverse views on whether funding will be extended or a shutdown will occur, providing an alternative data stream to traditional punditry. In this sense, prediction markets function as a decentralized barometer of the likelihood of different legislative outcomes.

As lawmakers navigate budget negotiations, traders use government shutdown bets to express opinions about congressional dynamics, budgetary constraints, and party leverage. The resulting prices incorporate information from policy statements, economic forecasts, and historical patterns, offering a nuanced view of what the market expects versus what is publicly stated. This dynamic can influence public perception and inform risk management strategies for businesses sensitive to government funding and policy changes.

LSI-Driven SEO: Why Kalshi and Polymarket Matter for Financial News

From an SEO perspective, Kalshi and Polymarket exemplify how prediction markets intersect with financial news and political reporting. Key terms such as prediction markets, Kalshi, Polymarket, US government shutdown, and government shutdown bets are repeatedly intertwined in coverage, helping search engines connect related topics. This alignment improves discoverability for readers seeking insights into how political events translate into market activity.

The integration of LSI terms in coverage also supports a richer understanding of how markets synthesize information about governance and policy risk. By highlighting the mechanisms behind event-based contracts, journalists can explain why prices move in response to negotiations, press conferences, and policy announcements. In turn, readers gain a clearer picture of how prediction markets function as a real-time reflection of political risk and its financial implications.

Risk, Regulation, and Government Shutdown Bets

Risk management considerations are central to government shutdown bets, with participants evaluating not only political risk but also regulatory frameworks governing prediction markets. Kalshi and Polymarket operate under specific guidelines that shape the types of events traded, settlement rules, and eligibility for certain bets. Understanding these rules is essential for anyone looking to engage with political outcome contracts responsibly.

Regulatory developments can also influence market dynamics, affecting liquidity, cost of capital, and the speed at which contracts are created or settled. As policymakers debate oversight and compliance, market participants monitor how potential changes might impact predictability, settlement procedures, and transaction costs. The resulting environment emphasizes the importance of transparent, well-defined contracts when betting on sensitive political events like a government shutdown.

Historical Context: Past Government Shutdowns and Market Reactions

Historical episodes of government shutdowns provide a backdrop for current betting activity on Kalshi and Polymarket. Past funding gaps and impasses have created measurable effects on markets and sentiment, informing how traders price the probability of a shutdown today. The comparative analysis of prior episodes helps explain why bets remain attractive to those seeking to quantify political risk.

Looking back at previous standoffs, traders have sometimes anticipated delays in funding or negotiated extensions, only to see outcomes diverge from initial expectations. The presence of a robust prediction-market market around a potential shutdown reflects a broader market appetite for information and risk-taking related to government policy, even when the specifics of a future event remain uncertain. This historical lens reinforces that markets often respond to headlines, policy signals, and crowd dynamics in a way that diverges from conventional forecasts.

User Demographics and Degens: Who Bets on These Events?

A notable segment of prediction-market participants includes degens and risk-tolerant traders drawn to high-volatility political bets. Kalshi and Polymarket attract users who experiment with strategies around government shutdown bets, aiming for outsized payouts if events unfold as priced. The appeal lies in the blend of political relevance and financial upside, drawing a diverse audience that spans casual readers to professional traders.

Beyond the degenerate gambling stereotype, a broader user base engages with prediction markets to hedge exposure, gain quick feedback on political developments, or test market-based narratives. Traders often monitor real-time updates on negotiations, public policy statements, and economic indicators, adjusting their bets as risk assessments evolve. The result is a dynamic marketplace that mirrors, in compressed form, the uncertainty surrounding federal funding and governance.

Future Trajectories: Where Kalshi and Polymarket Might Go

Looking ahead, Kalshi and Polymarket are likely to expand the scope of tradable political events, increasing both liquidity and user engagement. As the platforms grow, investors may view them as more than speculative venues, integrating them into broader risk management and informational ecosystems. The push toward more diverse events can reinforce the market’s role in forecasting policy outcomes and the potential economic impact of legislative stalemates.

As regulatory clarity evolves and user adoption deepens, the prediction-market landscape could see innovations in contract design, settlement clarity, and risk controls. The growing dominance of Kalshi and Polymarket in political event trading signals a trend toward mainstream acceptance of prediction markets as tools for information discovery and price discovery. The long-run trajectory will hinge on how well these platforms balance accessibility with responsible, compliant operation.

Impact on Real-World Policy and Federal Workforce

The dynamics of government shutdown bets touch real-world policy considerations and the welfare of federal workers. Market prices reflect anticipated policy outcomes, which can influence stakeholder expectations, employer planning, and public discourse around funding. While prediction markets do not dictate policy, they contribute to a broader information environment where risk assessments and economic projections are more visible.

Federal workers, contractors, and related industries may feel ripple effects if a shutdown persists, guiding how participants in Kalshi and Polymarket price contracts tied to funding timelines, payroll, and emergency funding. As markets capture sentiment about the duration and consequences of a government shutdown, they provide a quantitative lens through which analysts can discuss potential policy responses, workforce implications, and downstream economic effects.

Conclusion: What the Market Signals Tell Us About the Shutdown

The convergence of predictions on Kalshi and Polymarket—where the government shutdown is treated as an almost inevitable outcome—offers a snapshot of market sentiment amid political deadlock. By tracking the price signals and trading activity, observers can glean how participants expect policy, funding, and public-sector dynamics to unfold. The message from prediction markets is clear: the consensus is leaning toward a shutdown scenario with meaningful economic and policy implications.

As the political weather shifts, prediction markets will continue to serve as real-time gauges of uncertainty, providing a complementary perspective to polls and official statements. For readers and traders, the evolving contracts around government shutdown bets help illuminate the risks and potential outcomes that shape financial and policy decision-making. In this sense, Kalshi, Polymarket, and their peers function not only as betting venues but also as early indicators of how the market perceives the likely path of U.S. governance.

Frequently Asked Questions

What are US government shutdown prediction markets, and how do Kalshi and Polymarket fit into this space?

US government shutdown prediction markets are platforms where participants trade contracts based on whether a government shutdown will occur by a target date. Kalshi and Polymarket are two prominent examples that list such contracts, allowing traders to express probability through market prices. Prices move as new information arrives and traders buy or sell bets on the outcome.

How do Kalshi and Polymarket price the probability of a US government shutdown?

On Kalshi and Polymarket, contract prices reflect the market’s perceived probability of a US government shutdown by the contract’s expiration. Traders buy yes/no contracts, and odds adjust with news, policy developments, and liquidity.

Why do US government shutdown prediction markets on Kalshi and Polymarket show high odds for a shutdown?

These odds reflect perceived likelihood given current political dynamics and risk appetite among market participants; however, they are not guarantees of an actual shutdown.

What are government shutdown bets on Kalshi and Polymarket, and how do they settle?

Government shutdown bets on Kalshi and Polymarket are contracts that pay out if a shutdown occurs within the contract’s defined window. Settlement follows each platform’s rules, and payouts are typically in USD or the platform’s currency.

What risks should traders consider when using Kalshi or Polymarket for US government shutdown bets?

Risks include regulatory changes, liquidity gaps, platform risk, and potential market manipulation. Always review contract specs, fees, and settlement rules before placing US government shutdown bets on Kalshi or Polymarket.

Do US government shutdown prediction markets like Kalshi and Polymarket influence policy or political messaging?

Prediction markets like Kalshi and Polymarket primarily reflect beliefs and information prices rather than shaping policy, but heavy trading can influence public perception.

What are key differences between Kalshi and Polymarket in US government shutdown prediction markets?

Kalshi and Polymarket differ in listing processes, regulatory status in the US, fee structures, and settlement mechanics for US government shutdown prediction markets.

Where can I check current odds for a US government shutdown on Kalshi and Polymarket?

To view current odds for a US government shutdown on Kalshi or Polymarket, visit each platform’s event page and check the specific contract listings, including live odds and trading volume.

| Key Point | Details |

|---|---|

| Prediction stance | Kalshi and Polymarket view a US government shutdown as a done deal; probability cited above 78%. |

| Trading activity | Bets exceed $4.6 million, indicating high market interest. |

| Markets in flux | Last-minute negotiations cannot be ruled out; parties refuse to budge. |

| Key statements | JD Vance: ‘I hope they change their mind, but we’re going to see’; Trump warns of mass layoffs if shutdown occurs. |

| Milestones | Kalshi traded about $500 million over a weekend; volumes approaching or surpassing election-day highs. |

| Future outlook | Firms weighing fundraising rounds at valuations in the billions; ongoing growth in political-event markets. |

Summary

US government shutdown prediction markets Kalshi Polymarket illustrate how political risk is priced on prediction platforms. Bets have high probability estimates, with above-78% assessments and multi-million dollar volumes, highlighting strong market sentiment even as negotiations stall. Kalshi reportedly traded about $500 million in a single weekend, and both platforms are weighing fundraising rounds at valuations in the billions, underscoring the monetization and growth of political-event markets. As policymakers clash, these markets reflect, measure, and possibly influence expectations around a potential federal shutdown.