In the world of cryptocurrency, XRP price analysis remains a critical focal point for investors and traders alike. Currently hovering at $2.64, XRP showcases a market cap of $156 billion alongside a robust trading volume of approximately $3.66 billion. As traders analyze XRP’s chart, they are particularly attentive to key resistance levels around $2.70, which could dictate the next move in this digital asset’s price trajectory. The ongoing trend showcases promising indicators, especially when considering XRP’s price prediction amid fluctuating market conditions. With each uptick in XRP’s trading volume, the potential for breakout gains becomes increasingly enticing.

When examining the latest developments with XRP, an alternative perspective emerges that emphasizes the asset’s market dynamics. The XRP digital token is capturing significant attention amongst traders, showcasing compelling patterns on its price chart. As observers dissect possible resistance levels, the focus shifts toward $2.70 as a pivotal threshold—one that could either uplift or undermine bullish momentum. Increasing interest in XRP trading, coupled with its healthy market capitalization, contributes to ongoing discussions regarding future price predictions. The intricate interplay of XRP’s trading volume and market sentiment sets the stage for a riveting chapter in crypto investment narratives.

XRP Price Analysis: Current Trends and Projections

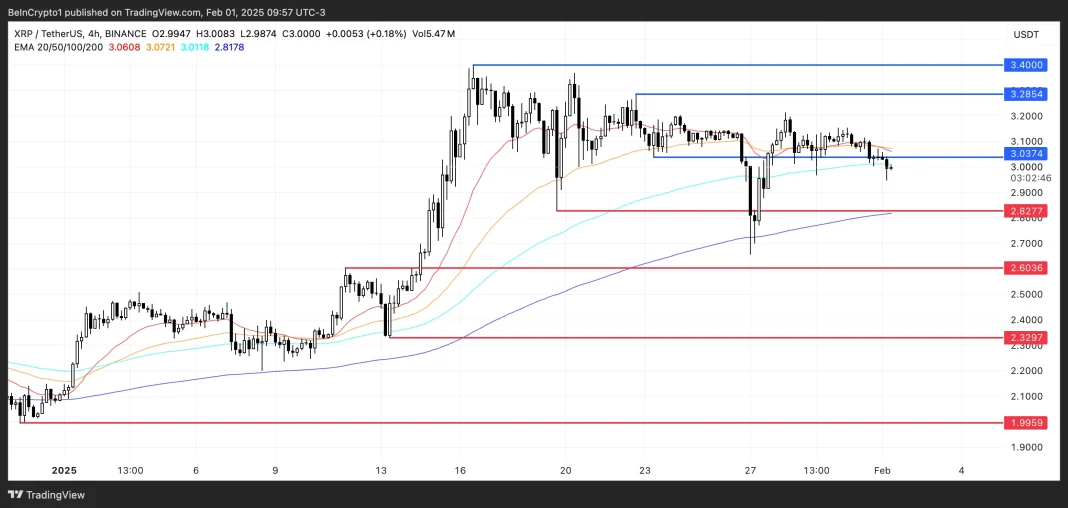

As of the latest analysis, XRP is holding steady at around $2.64, which signifies a robust market presence with a capitalization of approximately $156 billion. The trading volume has displayed an active engagement in the market, reaching around $3.66 billion, indicating healthy liquidity. Observing the price action on the chart, XRP has demonstrated a consistent uptrend after bouncing back from a low of $2.43 to achieving an intraday high of $2.642. The overarching analysis suggests that the current price levels are critical as they hover close to a significant resistance at $2.70. If XRP successfully breaks through this level, it sets the stage for potential upward movement towards $2.80, marking an important resistance milestone for traders to consider.

Digging deeper into the technical indicators, the recent price action on both the 1-hour and 4-hour charts suggests a bullish sentiment, albeit with caution. The oscillators reflect a neutral position, with the RSI hovering around 50 and the stochastic oscillator indicating momentum without extreme conditions. These signs highlight that while there may be upward pressure, traders should remain vigilant about potential retracements, particularly if XRP revisits the support range between $2.54 and $2.56. Given the current trading environment, prudent investors should also keep an eye on XRP’s resistance levels as they strategize their entry and exit points during this dynamic phase.

Understanding XRP’s Resistance Levels and Market Movements

Resistance levels serve as pivotal points in technical analysis where the price of an asset might struggle to advance further. For XRP, the current focus lies on the $2.66 and $2.70 marks, which are crucial thresholds for bullish traders. A breakout above these levels might not only confirm the strength of the uptrend but also attract further buying interest, potentially catapulting XRP towards the $2.80 level and beyond. On the other hand, establishing a firm resistance could lead to price stagnation or retraction, with traders looking for buy opportunities around established support zones, particularly between $2.54 and $2.56. These dynamics indicate that resistance levels play a vital role in shaping traders’ strategies and market sentiment around XRP.

Further examining the historical price points, the previous spikes and retracements offer valuable insights into XRP’s behavioral patterns in fluctuating market conditions. Traders should watch how XRP reacts upon testing the aforementioned resistance. If it fails to break past $2.70, it could potentially signal a bearish reversal, leading to increased selling pressure. Moreover, with the backdrop of XRP’s relatively high trading volume, a sustained upward breakout could lead to an influx of capital, reinforcing bullish sentiment in the market. Investors who align their strategies around these resistance trends can navigate the volatility more effectively, enhancing their potential for profitable trades over time.

XRP Trading Volume Insights: Analyzing Investor Engagement

Trading volume is a critical indicator of market activity and investor engagement, significantly impacting price movements of assets like XRP. Recently, XRP has exhibited a trading volume of around $3.66 billion—an indicator of active participation and liquidity in the market. Such levels reflect a confident trading environment; coupled with the current price dynamics, this volume suggests that many traders are anticipating a potential breakout or significant price action in the near term. The ability to maintain strong trading volumes during fluctuations can provide vital support levels necessary for the asset to travel higher amidst varying market conditions.

However, analysis of the trading volume also informs investors about potential exhaustion points. In XRP’s case, while the trading volume has been healthy, the recent upward movement has been accompanied by less pronounced increases in volume, which may suggest a lack of conviction behind the trend. This could signal that bullish momentum may be waning, prompting traders to reconsider their positions. Observing volume patterns alongside price movement can provide a comprehensive picture of market sentiment; therefore, astute investors should remain vigilant about these trends to optimize their trading strategies in the volatile crypto landscape.

XRP Market Cap: Evaluating Its Impact on Overall Performance

XRP’s market capitalization, presently at $156 billion, serves as a vital metric for assessing the asset’s performance relative to the broader cryptocurrency market. This substantial market cap positions XRP as one of the leading digital assets, drawing interest from both institutional and retail investors alike. A rising market cap traditionally indicates growing investor confidence and increased adoption, which can foster further price appreciation. For XRP, maintaining a favorable market cap amid price fluctuations will be crucial in boosting its perceived stability and attractiveness in the market.

With the valuation of XRP holding its ground, market participants should also consider the implications of market cap on price elasticity. A high market cap often results in less volatility compared to cryptocurrencies with smaller market caps, as larger investments tend to have more stable price effects. Furthermore, a healthy market cap can enhance XRP’s competitive edge against other digital currencies, particularly in scenarios where market sentiments shift dramatically. Therefore, vigilant observation of XRP’s market cap alongside its trading activity is essential for making informed trading decisions and evaluating potential future movements.

XRP Chart Analysis: Unveiling Trends and Signals

The XRP chart has recently provided traders with multiple signals pointing to potential price action. Based on the 1-hour and 4-hour analyses, XRP is currently navigating through a defined uptrend characterized by a series of higher highs and lows. The chart highlights critical levels such as $2.62 and $2.66 as immediate hurdles. Traders should note that consistent chart patterns, alongside the historical price thresholds established in recent days, can help in predicting localized support and resistance levels. Recognizing these patterns is essential for capturing short-term trading opportunities or positioning for longer-term investments.

Additionally, the application of various technical indicators on the XRP chart reveals mixed but interesting signals. While the moving averages suggest a bullish alignment in short-term frames, the longer-term indicators exhibit some hesitancy. This divergence stresses the importance of a multi-timeframe analysis strategy in trading, allowing for a more nuanced perspective on market conditions. Observing how future price actions correspond with these signals can offer insight into potential bullish or bearish trajectories. Chart analysis, in combination with key indicators, serves as an invaluable resource for traders navigating the complexities of the XRP market.

XRP Price Prediction: What to Watch For

As we scrutinize XRP’s potential future price movements, immediate resistance levels around $2.66 and $2.70 are critical factors to monitor. If XRP can overcome the $2.70 threshold, it could surge towards higher targets, possibly reaching the $2.80 mark. Such a movement would also be contingent on maintaining solid trading volumes that support the bullish move. Conversely, if XRP remains entangled below this resistance, traders may see renewed selling pressure, particularly if it falls below the support levels at $2.54 or $2.45. These points are essential for anticipating price reversals or continued consolidations.

Moreover, the overall market sentiment plays a significant role in executing accurate XRP price predictions. Factors such as regulatory news, market trends, or macroeconomic variables can profoundly impact trader confidence and overall price movements. Therefore, keeping abreast of not only XRP-specific news but broader cryptocurrency market shifts is crucial when attempting to predict XRP’s future. As global economic conditions evolve, XRP’s trajectory may experience volatility, but savvy investors and traders will appreciate the importance of nuanced analysis and monitoring upcoming developments that could sway its course.

Technical Indicators: Gauging XRP’s Future Movements

In the realm of cryptocurrency trading, technical indicators serve as essential tools for assessing asset movements and future price behavior. For XRP, the current readings from indicators like the RSI, MACD, and moving averages present a mixed sentiment. With the RSI sitting at a neutral level of around 50.91, it indicates that XRP isn’t in overbought or oversold territory; thus, the probability of a breakout could persist. On the other hand, the MACD level remains negative, suggesting bearish influences that traders need to consider before entering positions.

Furthermore, examining moving averages can yield valuable insights regarding XRP’s strength and trend direction. The alignment of shorter-term moving averages demonstrating bullish momentum hints at the possibility of sustaining momentum towards upward targets. However, potential resistance from longer averages indicates that traders should remain cautious and ready for possible reversals. By actively tracking these technical indicators, investors can make informed decisions and adapt their trading strategies, maximizing the chances of capitalizing on XRP’s price actions.

Navigating XRP’s Volatility: Strategies for Traders

Volatility is a defining characteristic of the cryptocurrency market, and XRP is no exception. For traders looking to navigate these increasingly dynamic price movements, establishing a clear strategy tailored to individual risk tolerance and investment goals is crucial. Day traders may focus on capturing short-term price fluctuations by employing technical analysis tools and real-time data to implement timely buy and sell orders aligned with intraday trends. For swing traders, a broader perspective allows for capitalizing on multi-day price actions, particularly if XRP breaks key resistance levels or retraces to established support zones.

Furthermore, having an exit strategy in place is essential when dealing with volatile assets like XRP. Setting clear price targets, stop-loss orders, or scaling out of positions can help secure profits and manage potential losses effectively. Given the rising trading volume and fluctuating sentiment around XRP, disciplined trading practices will empower traders to stay alert and responsive to sudden market changes. As the crypto space evolves and XRP continues to mature, those who remain adaptable and informed will be better positioned to capitalize on the opportunities and challenges presented by this energetic market.

Frequently Asked Questions

What are the latest insights from XRP price analysis?

XRP price analysis shows the token trading around $2.64, with short-term support at $2.45 and critical resistance near $2.70. Recent trends highlight an upward movement, but caution is advised due to decreasing trading volume.

How does XRP price prediction indicate future movements?

Current XRP price prediction suggests that if the price exceeds $2.70, it may rise to $2.80. However, a failure to maintain above $2.50 could lead to a retracement towards $2.42.

What are the significant XRP resistance levels identified in recent analysis?

XRP resistance levels to monitor include $2.66 as immediate resistance, followed by $2.70, with potential targets extending to $2.75 and $2.80 depending on market momentum.

What does XRP trading volume indicate about market sentiment?

Currently, XRP trading volume stands at approximately $3.66 billion. This relatively lower volume may suggest weakening bullish momentum, necessitating close observation for potential changes.

How does XRP market cap influence its price analysis?

With a market cap of $156 billion, XRP’s significant valuation supports its price stability. However, this cap can amplify volatility during sharp price movements, impacting overall price analysis.

What does XRP chart analysis reveal about its future potential?

XRP chart analysis indicates a mixed outlook with bullish behavior in short-term indicators and caution in long-term trends. Traders are advised to watch critical support and resistance levels for guidance.

What oscillator readings are included in the XRP price analysis?

In XRP price analysis, the Relative Strength Index (RSI) is at 50.91, indicating neutrality, while the Stochastic oscillator shows potential bullish momentum, though caution is warranted given the mixed indicators.

How has XRP reacted to key support zones in the past?

XRP has frequently respected key support zones, particularly between $2.45 and $2.50. If the price dips into this range, historical trends suggest a possible rebound could occur.

What role do moving averages play in XRP’s price analysis?

Moving averages in XRP’s price analysis show a bullish alignment in short-term frames, but longer-term averages signal caution, illustrating the importance of transitional trends for traders.

| Timeframe | Price Range | Key Support/Resistance | Market Sentiment | Technical Indicators |

|---|---|---|---|---|

| 1 Hour | $2.43 – $2.642 | Resistance at $2.66, $2.70; Support at $2.54 – $2.56 | Cautiously optimistic; plateauing momentum | RSI: 50.91; Stochastic: 75.37; CCI: 23.10; ADX: 39.87; MACD: -0.09677 |

Summary

XRP price analysis indicates that the cryptocurrency is currently trading at $2.64, with a significant market cap of $156 billion. With key resistance levels at $2.66 and $2.70, traders are watching how XRP responds to these ceilings. Despite a bullish short-term trend, concerns remain regarding volume and longer-term signals. The sentiment appears cautiously optimistic as traders await a decisive movement, either breaking upward or consolidating downward.