Zcash price surge as ZEC vaulted over 60% in 24 hours to a 2025 high around $124. The move came alongside a sharp uptick in ZEC trading volume and growing interest in privacy coins Zcash. Thorswap integration and renewed investor enthusiasm through the Grayscale Zcash Trust helped push the rally higher. Analysts cited the ZEC price 2025 levels as a driver behind the renewed attention. Overall momentum lifted the market cap and kept Zcash in the spotlight across several exchanges.

Beyond the headlines, the move reflects a broader phase of renewed activity in privacy-preserving digital assets. Traders describe it as a cross-chain rally where a privacy-focused token gains traction as liquidity flows into trackers and exchanges. Analysts note that the narrative centers on on-chain privacy, scalable architecture, and the potential for mainstream institution interest in niche assets. Such dynamics echo prior cycles where investors sought alternatives to traditional rails, fueling price moves in parallel with broader altcoin momentum. As the market digests the rally, many observers stress the importance of secure storage and responsible exposure to this privacy-centric cryptocurrency.

Zcash price surge: Key drivers behind a 60% spike and a 2025 high

Thorswap integration boosts ZEC liquidity and cross-chain trading

Grayscale Zcash Trust: A catalyst for institutional exposure to ZEC

Surging ZEC trading volume underpins the price move

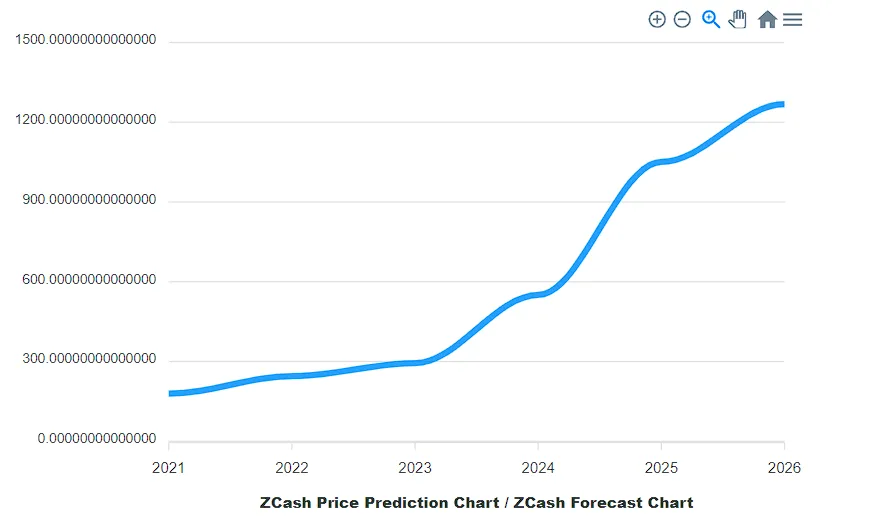

ZEC price 2025 trajectory: Where Zcash is headed after the rally

Privacy coins Zcash in focus amid broader crypto market dynamics

Social sentiment and influencer remarks shaping Zcash dynamics

Monero comparison: Zcash vs Monero as privacy-focused assets

Thorswap’s role in accessibility: ZEC-BTC swaps and privacy-preserving trades

Market capitalization, future catalysts, and what lies ahead for ZEC

Frequently Asked Questions

What caused the Zcash price surge to hit a 2025 high, and what were the key catalysts behind the ZEC price 2025 rally?

The Zcash price surge—often discussed as the ZEC price 2025—spiked over 60% in 24 hours, briefly approaching $124. The rally was driven by multiple catalysts, including the Thorswap integration that enabled ZEC/BTC swaps, renewed investor interest around the Grayscale Zcash Trust, and a sharp increase in Zcash trading volume, signaling stronger liquidity and demand.

How did Zcash trading volume influence the ZEC price surge?

Zcash trading volume surged from under $100 million to nearly $450 million in the lead-up to Oct 1, helping fuel the ZEC price surge to 2025 highs by increasing liquidity and market activity.

What is Thorswap integration and how did it relate to the Zcash price surge?

Thorswap integration refers to the decentralized exchange’s support for ZEC, enabling direct ZEC-BTC swaps. This cross-chain accessibility contributed to the Zcash price surge by expanding liquidity and attracting more buyers during the rally.

What is the Grayscale Zcash Trust and its role in the ZEC price surge?

The Grayscale Zcash Trust is a private-placement vehicle offering exposure to ZEC as a security for accredited investors. Its launch was cited as a catalyst behind the Zcash price surge, boosting investor interest in privacy-focused crypto assets.

How does privacy coins Zcash factor into the ZEC price surge?

As a privacy-focused coin, Zcash (ZEC) has drawn renewed investor attention during the surge in price and volume. The emphasis on privacy features helped position ZEC within the broader discussion of privacy coins amid market volatility.

Where can I track the ZEC price 2025 and related developments like Thorswap integration or the Grayscale Zcash Trust?

You can monitor the ZEC price 2025 and developments such as Thorswap integration and the Grayscale Zcash Trust on major market data sites, exchange announcements, and Grayscale updates. The latest figures show the 60%+ 24-hour rise with trading volume near $450 million and a peak around $124.

| Key Point | Details |

|---|---|

| Price Action | Zcash (ZEC) surged over 60% in 24 hours, hitting a 2025 high of $124. |

| Trading Volume | Volume jumped from under $100 million on Sept. 24 to nearly $450 million by Oct. 1. |

| Market Capitalization | Market cap rose from about $962 million to $1.95 billion. |

| Catalysts | Thorswap integration enabling ZEC/BTC swaps; Grayscale Zcash Trust private placement cited as a primary catalyst. |

| Investor Sentiment & Social Context | Renewed investor interest with social media discussion (e.g., mentions linked to the price surge). |

| Analyst Views | Some see Grayscale Trust as the main catalyst; others note potential mispricing versus Monero (XMR) according to Helius Labs’ CEO. |

| Historical Context | The last time ZEC traded near this level was May 9, 2022. |

| Notable Details | Thorswap described privacy coin accessibility and connectivity across chains; Grayscale Trust presents security-like exposure without direct custody. |

Summary

Conclusion: Zcash price surge reflects renewed interest in privacy-focused assets driven by exchange integration, institutional exposure, and rising trading activity. The surge in ZEC price was supported by Thorswap’s ZEC/BTC integration and the Grayscale Zcash Trust private placement, which together helped lift volume and market capitalization. While optimism remains, investors should weigh regulatory considerations and competition from other privacy-focused projects. Overall, the Zcash price surge signals potential for further volatility and upside if volumes stay elevated and institutional interest continues.